Want to understand the full sale process? Start by reading Essential Playbook—our weekly newsletter breaking down every stage of selling an essential services business, from prep to close.

End-to-end support from dedicated and licensed investment bankers with experience in your industry

Our investment bankers are legally licensed by FINRA

High-intent private equity owned platform buyers only, we do not sell to SBA buyers

Because we only sell businesses to private equity groups, offers are mostly full cash

Our technology enabled process ensures you have white glove service every step of the way. Investment Banking, Rebuilt for the Real World.

Our M&A advisors will walk you through what your business is worth, backed by real data.

We will identify and engage hundreds of buyers with relevant operating or investing experience.

Skip endless e-mail chains and upload documents in minutes using our secure portal.

Stay up-to-date on buyer activity in real-time through our centralized deal workspace.

The Advisory Investment Bank is a FINRA-licensed M&A firm specializing in essential services industries—including HVAC, plumbing, electrical, accounting and other real world businesses. We run a full-service, white-glove sell-side process designed to deliver top-tier terms and maximum valuation for founders. Backed by proprietary AI tools and a curated network of strategic and private equity buyers, we uncover every serious acquirer—so you never leave money on the table. We work for you, the business owner.

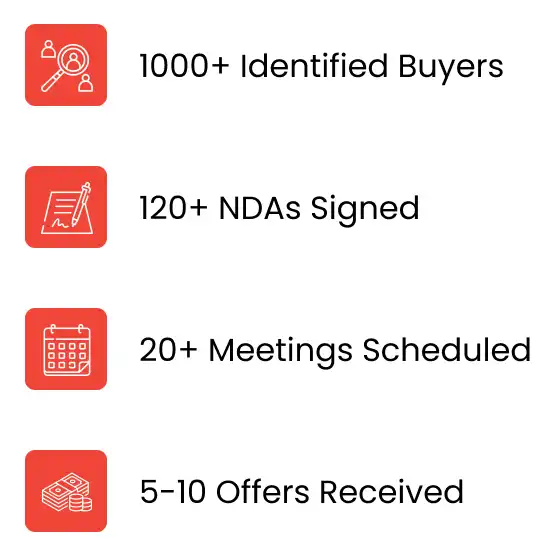

We maintain detailed profiles on over 4,500 private equity firms and strategic acquirers actively investing in essential services across the U.S. Our proprietary AI platform analyzes each firm’s strategy, portfolio, acquisition history, behavior, and geographic focus to surface the most relevant, best-fit buyers for your business. On average, our process identifies 1,000+ qualified buyers per deal—far exceeding the reach of traditional M&A firms.

We partner with profitable, founder-led businesses across the essential services landscape—HVAC, plumbing, electrical, fire safety, landscaping, facility maintenance, accounting, and more. Our clients typically generate $2–100 million in annual revenue and have at least 5 years of operating history. If you’re an operator who’s built something in the real world, we’re built to help you sell it right.

We operate on a 100% success-based model—no retainers, no upfront fees, no surprises. You only pay us when your deal closes. It’s that simple. Our incentives are fully aligned with yours from day one.

Once materials are ready, our clients typically receive qualified offers within 30–45 days, thanks to our streamlined process and AI-driven buyer targeting. From accepted offer to closing, expect an additional 60–90 days for buyer diligence and quality of earnings review. In most cases, deals are completed in 90–120 days total.

Speak with our M&A experts and take the first step toward a faster, more profitable exit.